Biodiversity and Emerging Market Debt; A rising area of focus for investors

ESG issues, from climate change to Covid-related social disruptions, remain a top concern for sovereigns, companies and investors alike. As these risks become more imminent, discussions surrounding potential solutions have taken on an increasing sense of urgency. In that spirit, Sustainable Fitch, CFA Society Hong Kong and the CFA Institute have come together collaborate on a series of webinars.

This series of ESG webinars will share insights by bringing together industry experts on key ESG topics and help you understand their impact on investing in the coming year and beyond.

Session 1 Webinar: Biodiversity and Emerging Market Debt; A rising area of focus

About Session 1 Webinar

Biodiversity loss is one of the top five risks in the 2020 World Economic Forum’s Global Risks Report. Many investors are attempting to integrate biodiversity performance assessment and risk management into portfolios, but facing challenges relating to the lack of clear data and transmission channels linking land use change and biodiversity loss to company activities.

Agriculture activities may contribute to deforestation. Use of fossil-fuel based chemicals to increase the farm yields in recent decades are proving to be deleterious to soil and groundwater health. These human activities do contribute to the biodiversity loss.

In this webinar, Mr. David McNeil, Head of Climate Risk, Director of Sustainable Fitch, will share with us:

- Background on policy developments and voluntary frameworks (e.g. CBD, TNFD)

- Challenges on measuring and monitoring biodiversity-related financial risks

- Best practice examples of biodiversity integration

- Links between biodiversity and climate mitigation goals

- Emerging nature based asset classes and opportunities

Mr. Sivananth Ramachandran, CFA, Director of Capital Markets Policy, India, at CFA Institute, will use the India experience to explore the following topics with audience:

- Various facets of sustainable agriculture

- Challenges in scaling up financing for sustainable agriculture projects

- Current financing models and case studies

- A call to action for policy makers, banks, and other stakeholders

In addition, Ms. Marina Petroleka, Global Head of ESG Research of Sustainable Fitch will discuss with the speakers on topical issues on biodiversity and sustainable agriculture. The panel speakers will also be taking questions from the participants toward the end of the webinar.

We hope you can join us for this event!

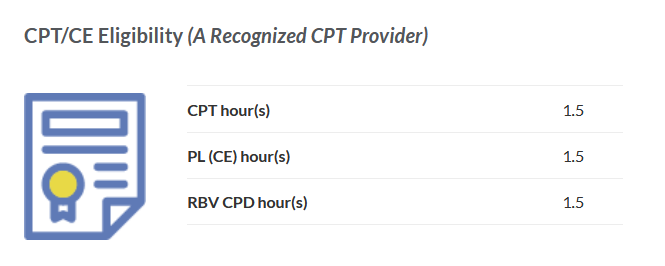

*This event is eligible for 1.5 CPT/PL hours. Complimentary CPT Attendance Letter will be issued to members of CFA Society Hong Kong and guests of Fitch Ratings.

*For other guests or members of other societies of CFA Institute, $150 is required for getting the CPT Attendance Letter. (Upon successful registration on Fitch Rating’s platform, CFA Society Hong Kong staff will follow up with you to complete the online payment. Please note that no request for an attendance letter will be processed after the event date.)

About the Speakers

Mr. David McNeil

Head of Climate Risk, Director

Sustainable Fitch

David McNeil heads the Climate Risk team within Sustainable Finance, which is focused on physical and transitional climate risk research and product development.

David is an environmental economist by background with experience supporting corporate, investor and public sector clients in ESG research.

Prior to joining Fitch David had roles at S&P Trucost, contributing to ESG product and low-carbon index development, and ICF International, supporting the EC, EIB and UK government on macroeconomic analysis of environmental policy.

Mr. Sivananth Ramachandran, CFA

Director of Capital Markets Policy, India

CFA Institute

Sivananth Ramachandran, CFA (Siva) is the Director of Capital Markets Policy, India at the CFA Institute. In his role, he is responsible for advocating policy positions on issues that impact Indian capital markets, including corporate governance, ESG, and pensions.

Siva has over fourteen years of experience in financial services. Prior to joining the CFA Institute, Siva worked at Morningstar, and led their global index product development team. He also served as a spokesperson for sustainability at Morningstar India. Prior to his time at Morningstar, Siva worked at MSCI where he co-authored research papers on small cap investing, portfolio construction, and economic exposure.

Siva has an MBA from the Indian Institute of Management, Lucknow. He also holds the Chartered Financial Analyst (CFA) and Professional Risk Management (PRM) designations, and the Fundamentals of Sustainability Accounting (FSA) credential provided by Sustainability Accounting Standards Board (SASB).

Ms. Marina Petroleka

Global Head of ESG Research

Sustainable Fitch

Marina Petroleka is Global Head of ESG Research in Fitch Ratings’ Sustainable Finance division, based in London. In her role, Marina leads a global team of research analysts undertaking detailed research and credit-relevant analysis on Environmental, Social and Governance (ESG) themes and cross-sector trends, as well as supporting and providing input for ESG-related research from all Fitch’s different analytical group areas.

Previously Marina was EMEA Regional Credit Officer at the Credit Policy Group, with a focus on Research. Her main responsibilities were leading cross sector, thematic credit research to ensure comprehensive analysis and awareness on major credit risks, across asset classes, but with a focus on Corporates.

Marina joined Fitch Ratings in April 2020 from Fitch Solutions where she was Global Head of Industry Research since 2016.

Previously, she lead BMI Research’s Energy and Infrastructure team for nearly a decade. She joined BMI Research (acquired by Fitch Group in 2014) in 2007 as an analyst in the Infrastructure team.

She holds a Bachelor’s degree in War Studies, and an M.A. in International Security and Development, both from King’s College, University of London.

Date And Time

06:30 PM

![[Member Exclusive Event] Awards Night 2024](https://cfasocietyhongkong.org/wp-content/uploads/2024/06/awards-night-2024-thumbnail.jpg)