Webinar: Financial Institutions & Climate Risk

ESG issues, from climate change to Covid-related social disruptions, remain a top concern for sovereigns, companies and investors alike. As these risks become more imminent, discussions surrounding potential solutions have taken on an increasing sense of urgency. In that spirit, Sustainable Fitch, CFA Society Hong Kong and the CFA Institute have come together collaborate on a series of webinars.

This series of ESG webinars will share insights by bringing together industry experts on key ESG topics and help you understand their impact on investing in the coming year and beyond.

Session 1 (on-demand): Biodiversity and Emerging Market Debt; A rising area of focus for investors

Session 2 (on-demand): ESG Themes for 2022

Session 3 (on-demand): ESG Investing Trends in China/APAC

Session 4 Webinar: Financial Institutions & Climate Risk

After successfully concluding a webinar on “ESG Themes for 2022” on February 24, Sustainable Fitch, CFA Society Hong Kong and CFA Institute ARX are glad to jointly host the 4th webinar in this series on March 22. At this webinar, Mr. Tim Chan, CFA, Vice President, member of the global sustainability research team of Morgan Stanley, and Mr. David McNeil, Head of Climate Risk, Director of Sustainable Fitch, will share with us their insights on financial institutions and climate risks. There will be a Q&A session moderated by Mr. David McNeil and joint by Mr. Monsur Hussain, Head of Financial Institutions Research of Fitch Ratings and Mr. Tim Chan after the individual presentations.

The speakers will cover the following topics in the webinar:

– Latest ESG market trends and development of global carbon market

– China’s decarbonisation journey and implications to financial institutions

– Different strategies for financial institutions to integrate climate risk

– Recent regulatory developments at the global/APAC level and implications for financial institutions

– Challenges for effective scenario analysis – qualitative versus quantitative assessment

– Practical examples of climate/ESG integration into credit risk management

– Strategies for financial institutions in the absence of climate data harmonization: best practice examples

– The physical climate risk and climate protection gap – challenges and opportunities

We hope you can join us for this event!

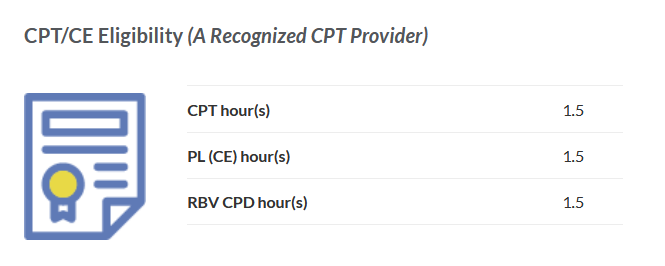

*This event is eligible for 1.5 CPT/PL hours. A complimentary CPT Attendance Letter will be issued to members of CFA Society Hong Kong and guests of Fitch Ratings.

*For other guests or members of other societies of CFA Institute, $150 is required for getting the CPT Attendance Letter. (Upon successful registration on Fitch Rating’s platform, CFA Society Hong Kong staff will follow up with you to complete the online payment. Please note that no request for an attendance letter will be processed after the event date.)

About the Speakers

Mr. David McNeil

Head of Climate Risk

Sustainable Fitch

David McNeil heads the Climate Risk team within Sustainable Finance, which is focused on physical and transitional climate risk research and product development.

David is an environmental economist by background with experience supporting corporate, investor and public sector clients in ESG research.

Prior to joining Fitch David had roles at S&P Trucost, contributing to ESG product and low-carbon index development, and ICF International, supporting the EC, EIB and UK government on macroeconomic analysis of environmental policy.

Mr. Monsur Hussain

Head of Financial Institutions Research

Fitch Ratings

Monsur is Head of Research for Global Financial institutions, and leads Fitch’s FI non-coverage research and publications. He is actively involved in investor outreach and has published articles on regulation and ESG topics in professional magazines.

Prior to joining Fitch, Monsur worked as an advisor at global investment banks, and read Modern History with Economics at the University of Manchester.

Mr. Tim Chan, CFA

Vice President

Morgan Stanley

Tim Chan is a vice president at Morgan Stanley who joined the firm in 2020 and is a member of the global sustainability research team, leading the ESG research in Asia Pacific. His team ranked #1 in the Institutional Investor All-Asia Research Poll in 2021. Prior to joining Morgan Stanley, Tim was a senior ESG analyst at Manulife Investment Management where he led the ESG integration, research and engagement efforts in North Asia. Previously, he worked as an advisory manager at Ernst & Young within their climate change and sustainability services team. Tim holds a bachelor of science in molecular biotechnology from the Chinese University of Hong Kong, and a master of science in environmental management from the University of Hong Kong. He is also a CFA charterholder, a chartered environmentalist and an EFFAS certified ESG analyst.

Rating General

Material presented will be basic and of interest to a general audience having no background in the area.

Terms and Conditions

By registering for this webinar, you are agreeing to the terms and conditions below.

1. You may be contacted by the co-hosts by email, phone and SMS in relation to the event you have registered for.

2. To qualify for CPT/PL hours, all participants must attend the full webinar. After the webinar, Society staff will verify participants’ check-in and check-out time from the registration system for the purpose of issuing CPT Attendance Letters. No pro-rata credit hours will be awarded.

3. The webinar will be conducted on Zoom.

4. Please log in the webinar link 10 mins in advance of the session start time to allow some time to solve the technical issues (if any).

5. For attendance-taking purpose, participants’ names and company names (if any) may be given to the speaker of this event.

6. Organisers will closely monitor and assess the ongoing situation of COVID-19 in the community. Should there be any changes to the event dates and other arrangements, we will notify participants by email. Notices will also be posted on our websites. Please stay alert with our notifications.

7. The event organizers reserve the right to change the format, date or speakers of the event due to unforeseen circumstances without prior notice.

8. In case of dispute, the decision of the event organisers is final, and no further correspondences will be entertained.

Date And Time

06:30 PM