Algo Trading Unleashed: Application and Impact on Cryptocurrency

Panel Discussion with FinTech Veterans

(CODE: 240326LU-CEX)

Join us for an enlightening evening as we explore the realm of Algo Trading (Algorithmic Trading), delving into its application and impact on cryptocurrency. We are privileged to have four distinguished practitioners who have successfully navigated the complexities of algorithmic application and virtual asset trading.

This event will feature a moderated panel discussion, providing valuable insights on trending and pertinent topics such as:

- The influence of cryptocurrency development on the traditional asset management industry.

- Considerations for investors when selecting crypto exchanges or custodians amidst the current regulatory landscape.

- Strategies to address counterparty risk in Algo Trading.

- Overcoming the challenges of data availability when conducting research on cryptocurrency, as opposed to traditional investment instruments.

- Forecasting trends in Algo Trading on cryptocurrency.

Don’t miss this exceptional opportunity to network and engage with seasoned industry experts, while gaining a deeper understanding of how technology is reshaping the finance industry in a rapidly evolving marketplace. Limited seats are available on a first-come, first-served basis!

(Light refreshment will be served at the event.)

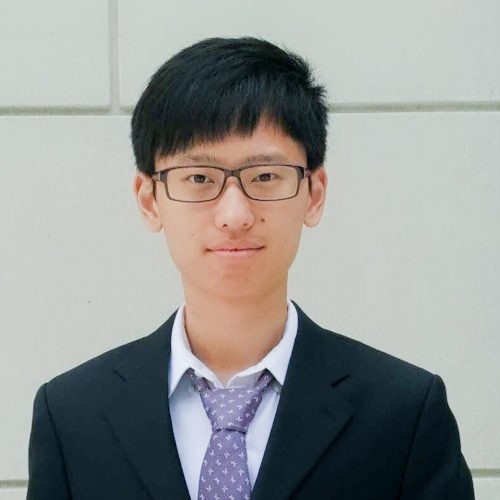

About the Speakers (in alphabetical order)

Partner and CFO

SignalPlus

Augustine is a Partner and CFO at SignalPlus, a HK/SG based technology company developing institutional-grade software servicing the digital asset sector.

Prior to joining the start-up scene, Augustine was a decade-long macro risk-taking veteran at Goldman Sachs, working across the firm’s New York, London, Tokyo, and Hong Kong offices. After leaving the sell-side, he served as the Investment Director and CIO for single family offices, expanding his mandate to cover private equity, real estate, structured lending, venture capital, and frontier co-investments globally.

Augustine is a CFA Charterholder, a Leslie Wong Fellow and holds a Bachelor of Commerce from the University of British Columbia with First Class Honours.

Founder

Epochs Research

Michael is the Founder of Epochs Research Limited, a Hong Kong-based hedge fund focusing on algo trading and quantitative investment strategies. He was previously a Portfolio Manager at JY Capital, Watervalley Capital Management.

Crypto Quantitative Portfolio Manager

Calvin Tsai is a seasoned professional in the field of algorithmic trading in cryptocurrencies, currently serving as a Crypto Quantitative Portfolio Manager. He manages a US$50m crypto systematic CTA portfolio, overseeing more than US$3b in monthly turnover in the crypto market. His prior roles include being a traditional hedge fund quant PM and a quant trader at a market-making firm.

In addition to his hands-on experience, Calvin is a respected voice in the financial community and a dedicated advocate for education in program trading. He co-founded the Hong Kong Program Trading Research Center (HKPTRC) and established the first educational organization in Hong Kong to promote program trading, demonstrating his commitment to fostering knowledge and understanding in this field. He is a regular contributor to over 10 financial magazines and newspapers, a guest on financial TV programs, and has been interviewed by major media outlets such as Bloomberg, Wall Street Journal, New York Times, BBC, and CBC.

Calvin is the author of two best-selling books, 《程式交易快穩準》and《程式交易的理論與實踐》. His influence extends to social media, where he has over 20,000 followers on Facebook and over 10,000 followers on Twitter. He graduated from the University of Hong Kong.

Co-Founder

AlgoBot

Rex is the Founder of Robo-Advisor AO Summit, Co-Founder of AlgoBot and Co-Founder and Chairman of Algo Challenge Association. He was previously Fund Manager at Topaz Capital Management Limited, Index Arbitrageur at Société Générale, and Portfolio Manager at Shanghai Commercial Bank.

He is also a regular guest speaker of RTHK, on.cc, InvesTalk, Sun Channel, HKEJ, etc. He holds a Master of Finance in Financial Engineering from the University of Hong Kong with Distinction.

Remarks

- Registration is requested, no walk-in will be entertained.

- Only registered participants are allowed to stay and attend the event.

- Registrations should be paid in full before the commencement of the activity. The Society reserves the right to disallow entrance to the activity for any unpaid registrations or registrations in doubt.

- Full amount of registration fee will still be charged for no show or enrolment made after 24th March 2024 (Sunday).

- For any cancellation of confirmed enrolment on or before 24th March 2024 (Sunday), an administration fee of HK$50 plus 50% of the registration fee will be forfeited. All cancellation requests must be made in writing and be confirmed by email from the Society.

- Refund of the registration fee (after deducting HK$50 administration fee and 50% forfeiture) will be given for cancellation received on/before 24th March 2024 (Sunday).

- For payment made by credit card, refund will be handled through the card-issuing bank. Please allow 4 to 6 weeks for processing. The amount will be refunded to the credit card used for payment.

- No refund will be given for cancellation received after 24th March 2024 (Sunday).

- Substitutions are allowed and please notify us no later than 24th March 2024 (Sunday) if such arrangement is required. Non-member rate applies if the substitute is not a CFA Society Hong Kong member.

- The event organizers reserve the right to change the format, date of the event due to unforeseen circumstances without prior notice.

- The event will be conducted in English.

- For attendance-taking purpose, participants’ names and company names (if any) may be given to the speaker of this event.

- Should there be any changes to the event dates and other arrangements, we will notify participants via SMS and/or email. Notices will also be posted on Society’s website. Please stay alert with our notifications.

- An additional administrative charge of HK$50 will be charged for participant who registers on the event day.

- In the event of a dispute, the decision of CFA Society Hong Kong shall be final and binding.

Personal Information Collection Statement

- Your personal data collected from the registration process will be used for the purpose of the administration of the course/event/activity on which you are registered (“Event”). Such data collected may be accessible by CFA Society Hong Kong’s officers, persons or committees processing the application and related matters. CFA Society Hong Kong reserves the right to inspect personal identity of participants. In addition, CFA Society Hong Kong may use the collected data for statistical research and analysis. By submitting this registration form, you understand and agree that CFA Society Hong Kong may provide your personal data to co-organizers/service providers in or outside Hong Kong for the purpose relating to the Event. For more information about the privacy policy of CFA Society Hong Kong, please visit here.

- CFA Society Hong Kong intends to use the personal data (including but not limited to your name, email address(es), mobile number and/or social media) to inform you, where relevant, of members’ benefits, goods, services facilities and events organized or provided by CFA Society Hong Kong or other organizations. Members and registered persons may opt out of receiving such materials at any time by sending an email to CFA Society Hong Kong at info@cfasocietyhongkong.org.

By registering for this event, you confirm that you and your guest(s) consent to appearing in any official event photographs and video footage.

- The photographs and video footage can be used by the Society for marketing and publicity in our publications, on our website and in social media, or in a third-party publication.

- In addition, photographs or video footage may be taken by other event attendees and publicly shared, for which the Society cannot be held responsible.

![[Level I Session] Ready for Battle – Mock Exam (Feb 2026) (10 Jan 2026)](https://cfasocietyhongkong.org/storage/photos/shares/2025/11/260110-event-banner-level1.jpg)